InsureSmart CRM

InsureSmart CRM

Powered by

Developed by Cloud Analogy, Trusted by Top Insurance Brokers

The Ultimate All-in-one Platform for Seamless Broker Management and Policy Administration, designed exclusively for Insurance Brokers.

What is InsureSmart CRM?

An Agenforce-powered, end-to-end CRM designed for Insurance Brokers. From Marketing, Quotes, Claims to Financial Reconciliation, this platform digitizes every step of the insurance broking journey.

Why It’s Needed Now?

Manual processes, Disconnected tools, Missed Renewals, and Limited Automation leads to unnecessary delay and dissatisfied clients. InsureSmart automate, integrate, and simplifies everything at one dashboard, streamlining workflows and boosting client satisfaction.

Top Challenges Insurance Brokers Face Without Switching to AI-powered CRM Solutions

Inefficient Lead Management

Manual tracking and nurturing of leads take time and effort, resulting in missed opportunities and slower conversions.

Limited Customer Insights

Disorganized data and a lack of proper analytics make it difficult to understand clients and deliver personalized resolutions.

Inadequate Renewal Tracking

Without automation, renewal deadlines are overlooked, and retention efforts are hindered, risking client faithfulness.

Time-Consuming Quote Generation

Outdated methods slow down quoting processes resulting in inaccuracies, causing dissatisfaction and uncompetitive pricing.

Poor Customer Experience

Delayed responses and no self-service options leave clients frustrated and dependent on brokers for every little task.

Inefficient Claims Processing

Manual handling of claims may cause delays and errors, which lead to clients' frustration, affecting their faith in your services.

Limited Scalability

Scaling operations requires heavy resourcing, which may lead to workflow inefficiencies and slower communication, reducing growth.

Inconsistent Client Engagement

Uncoordinated messaging and slowed outreach weaken relationships and reduce engagement opportunities.

Introducing InsureSmart CRM - An Insurance Broking Solution Powered by Agentforce!

The Smartest Solution to All-Things-Insurance Brokerage!

Automate, Collaborate, and Accelerate!

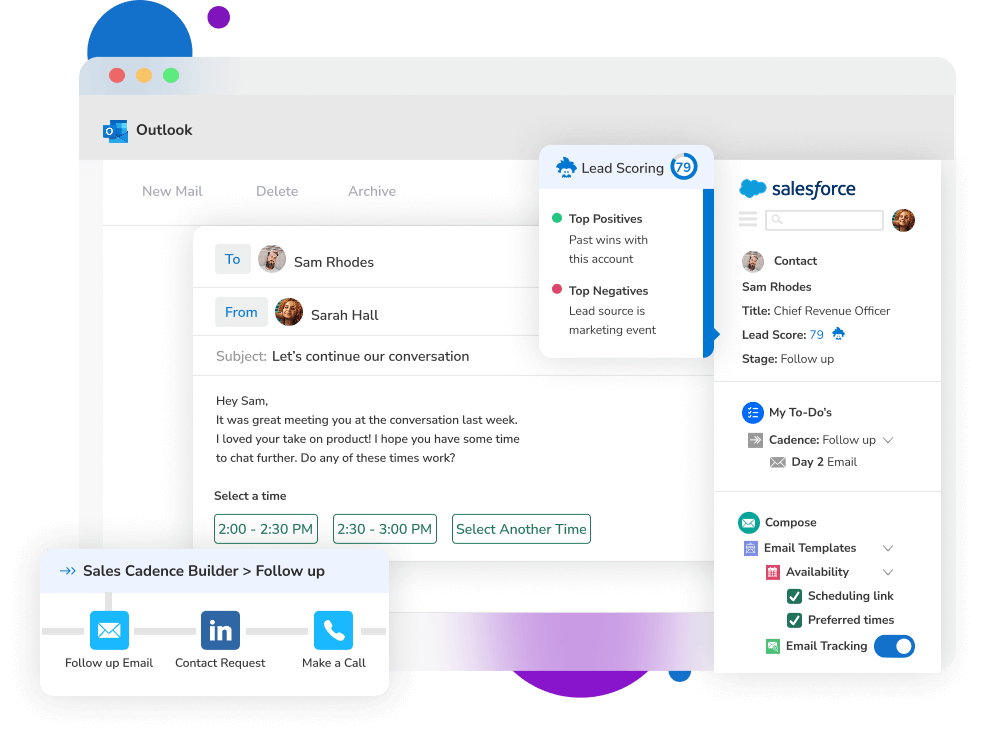

Complete Lead Management

Agentfore improves lead management by automating lead capture, scoring, and follow-ups. AI-driven insights help brokers with targeted marketing strategies while ensuring precise data tracking for better decision-making and conversion rates.

Predictive Renewal Tracking

Using predictive analytics, Agentforce’s agents notify the clients about the policies that are at risk of expiring. These agents ensure accurate data updates via system integration, maintaining policy continuity and client satisfaction.

AI-Powered Quote Generation

Agentforce’s AI agents seamlessly integrate with underwriting rules and pricing models to generate real-time, accurate quotes. These AI agents offer tailored options to clients to ensure personalized and accurate quoting processes via machine learning.

Streamlined Policy Administration

Agnetforce streamlines policy processes by integrating external data for compliance checks. It also provides analytics for policy performance. Role-based access controls are enforced to maintain data security, ensuring limited personnel can access sensitive information.

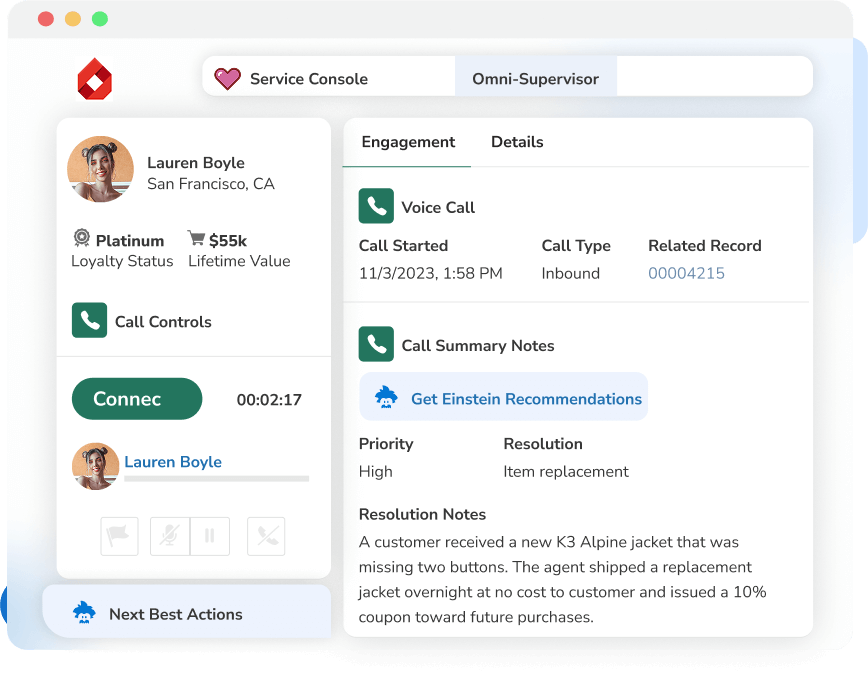

Automated Claims Processing

Agentforce automates claims workflows, reducing manual interference and delivering real-time status updates. Integration with risk assessment systems improves the accuracy and security of claims processing.

Smooth Customer Onboarding

Agentforce automates verification and approval workflows, ensuring accurate data capture and maintaining customer information throughout the lifecycle. Real-time communication updates keep customers informed during the onboarding process.

24/7 Customer Self-Service Portal

Agentforce facilitates secure access to policy details, claim status, and payment options through the customer self-service portal. Feedback tools and mobile access are provided to improve the overall customer experience.

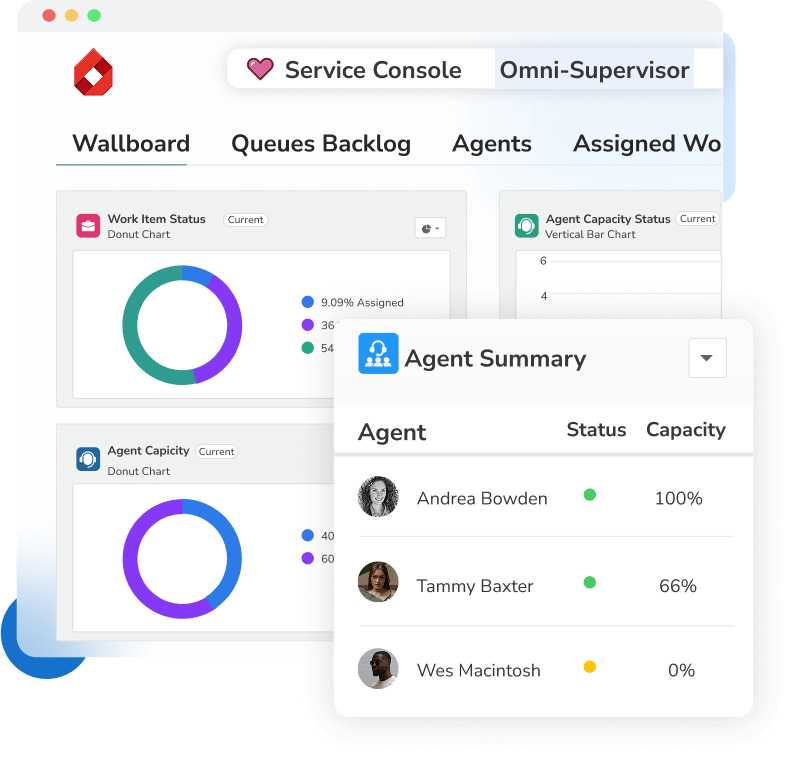

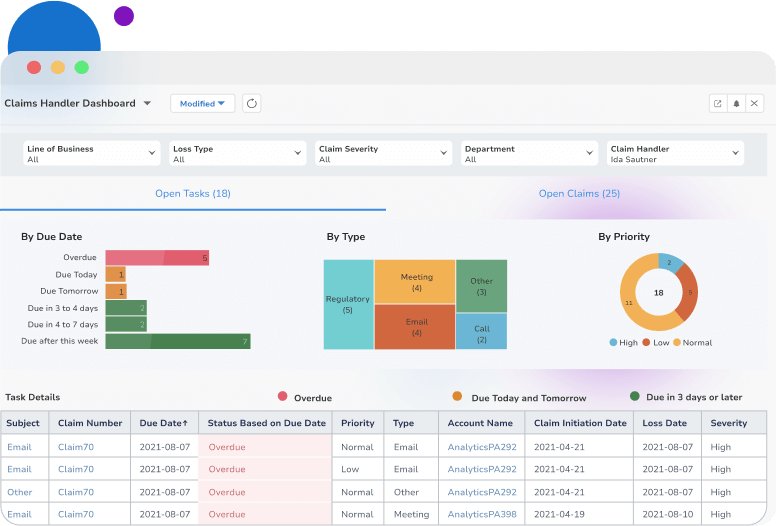

Insight-Driven Service Analytics

From real-time dashboards to reports, Agentforce uses predictive analytics & trend analysis for better decision-making. It automates notifications and alerts to keep brokers informed and proactive prior.

Smart Finance Reconciliation

Agentforce consolidates payment records and automates matching premiums and invoices, reducing time and effort. It enables real-time financial insights to ensure accurate records and compliance with financial regulations.

Integrations That Power InsureSmart CRM!

Making Processes – Seamless, Scalable, Smarter!

Use Cases: Real-World Applications

Discover how the absence of AI-powered solutions creates inefficiencies, slows growth, and impacts client satisfaction in critical areas of your business.

Secure & Streamlined Initial Engagement

Use Case: Agentforce confirms a client’s identity using mobile and email. It directs existing users to services and new users to lead generation.

Outcome: Faster communications build trust and improve information safety and security.

Effortless Lead Creation for New Customers

Use Case: Agentforce collects company and contact details of new clients, auto-creates a lead record, and ensures prompt follow-up.

Outcome: Simplified onboarding reduces wait times and improves confidence.

Tailored Assistance for Returning Customers

Use Case: Existing customers choose service options (e.g., policy inquiries, insurance claims) via Agentforce, which transmits queries for quick resolution.

Outcome: Personalized solutions enhance effectiveness and customer satisfaction.

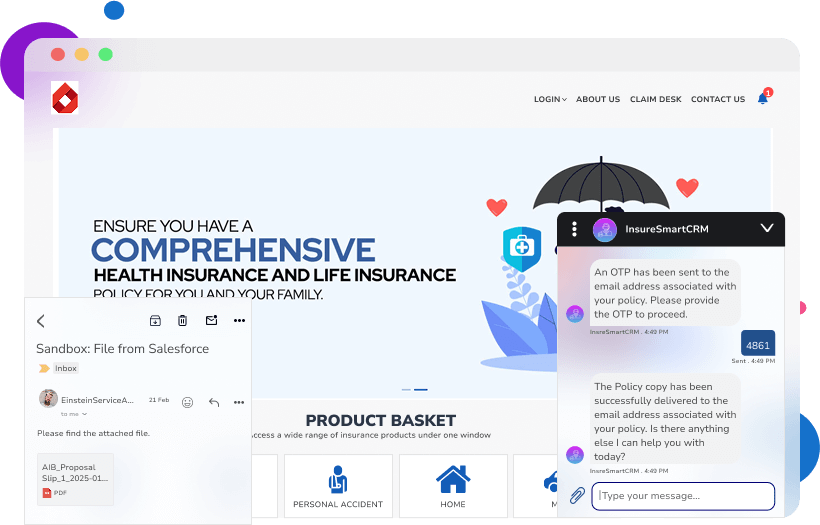

Instant Policy Document Access

Use Case: Customers retrieve policy papers by providing their plan number and setting off a safe download link.

Outcome: Hassle-free access improves convenience and also reduces managerial work.

Efficient Claims Management

Use Case 1: Customers check out claim status by sending their claim number for real-time updates.

Use Case 2: New claims are initiated, documented, and also assigned to a Relationship Manager. Customers can check the claim status by using Agentforce.

Outcome: Transparent and rapid claims processing.

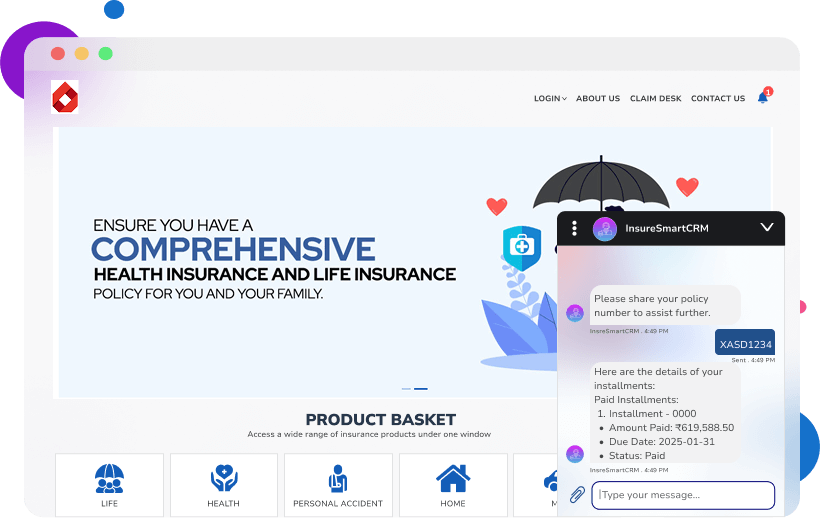

Complete Policy Installments Management

Use Case: Customers input their policy number into Agentforce to immediately access installment details, which include payment statuses, due dates, and amounts.

Outcome: Enhanced financial clarity, allowing better payment management and timely decision-making.

Success Metrics: Proven Results

Why Cloud Analogy’s InsureSmart CRM-powered by Agentforce is the No. 1 choice of Leading brokers?

Faster Claims Processing

Increase in Lead Conversion

Reduction in Operational Costs

Automation in Policy Renewals

No Matter the Policy, We Have the Perfect Coverage that Best Suits Your Needs!

Commercial Property Insurance

General Liability Insurance

Cyber Insurance

Professional Indemnity (Errors & Omissions) Insurance

Directors & Officers (D&O) Insurance

Workers' Compensation Insurance

Business Interruption Insurance

Trade Credit Insurance

Employer's Liability Insurance

Marine & Cargo Insurance

Construction & Engineering Insurance

Group Health & Employee Benefits

What Leading Insurance Brokers Are Saying About Us

InsureSmart CRM has totally redefined how we handle our brokerage. From lead capture to claims processing, everything operates smoother and faster. It's like having a digital assistant that never rests & cheats!

The Agentforce-powered self-service portal alone is a game-changer. Our customers love the capability to track policies and submit claims in real time. It's helped us enhance client satisfaction and reduce support headaches.

We struggled for years with renewal tracking and client engagement. With InsureSmart, everything is streamlined and faster than ever - we now connect with clients before they even know they need us.

Frequently Asked Questions

Yes, totally! The Basic plan is free. You can have unlimited personal files and file viewers. Maximum 1 team project can be created with 2 team files and 2 editors. You also have access to the Spline Library and can publish your scenes with a Spline logo.

Yes, totally! The Basic plan is free. You can have unlimited personal files and file viewers. Maximum 1 team project can be created with 2 team files and 2 editors. You also have access to the Spline Library and can publish your scenes with a Spline logo.

Yes, totally! The Basic plan is free. You can have unlimited personal files and file viewers. Maximum 1 team project can be created with 2 team files and 2 editors. You also have access to the Spline Library and can publish your scenes with a Spline logo.

Yes, totally! The Basic plan is free. You can have unlimited personal files and file viewers. Maximum 1 team project can be created with 2 team files and 2 editors. You also have access to the Spline Library and can publish your scenes with a Spline logo.