The threat of coronavirus has spread its wings across continents within no time. Epidemiologists are nervously tracking signs that the severe acute respiratory syndrome coronavirus-2 (SARS-CoV-2) is spreading widely beyond its origins in China. The global outbreak has already resulted in upheaval in stock markets and disruptions in supply chains around the world.

More than 3,000 deaths have been reported from coronavirus that has infected more than 89,000 people. The infection rate of the virus has slowed down in China in recent weeks, but new outbreaks in Italy, Iran, and South Korea threaten to turn coronavirus into a pandemic.

The extent of the coronavirus can be measured from the fact that the U.S. Federal Reserve took aggressive steps in an attempt to contain the damage. The Fed, as a pre-emptive move to protect the economy from the coronavirus, announced it would slash interest rates by half a percentage point, its biggest single cut in more than a decade. It was signaled by Jerome H. Powell, the Fed chair, that further moves were possible and added that the Federal Reserve was prepared to use our tools and act appropriately, depending on the flow of events.

So far, there have been no noticeable signs of widespread economic damage, at least in the United States. Shops and restaurants remain open. Consumers are still spending. Most employers aren’t laying off workers. The move by the Federal Reserve is an effort to keep it that way.

Economists around the globe are of the view that a recession could be stimulated in the United States by a pandemic. But for that to happen, the effects would have to spread beyond travel, manufacturing, and other sectors directly affected by the fatal disease.

Tara Sinclair, an economist at George Washington University, said the real sign of trouble would start when organizations with no direct connection to the virus will start reporting a slump in business. Sinclair commented the key is to watch big macro numbers rather than obsessively watching things tied to virus and supply chains.

What The Markets are Telling Us?

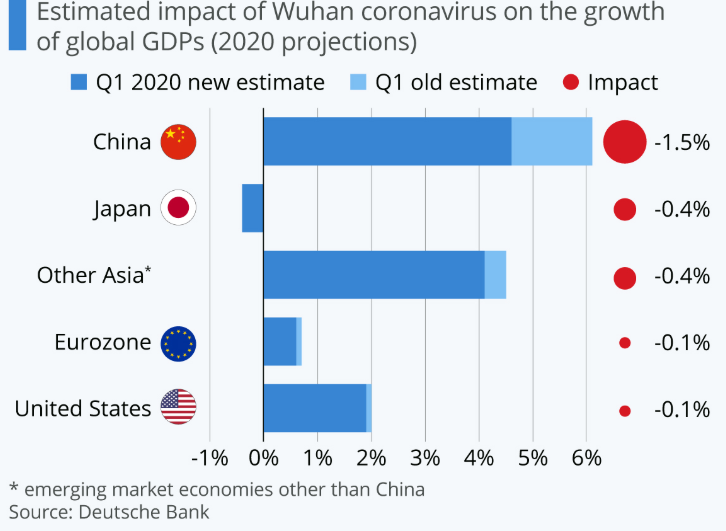

The worst part is that the world economy has been hit by the Covid-19 crisis when growth is already on the softer side and many countries are wildly overleveraged. In 2019, global growth was only 2.9 percent, not so far from the 2.5% level that has historically constituted a global recession.

Germany has been teetering in the middle of political disarray, the economy of Italy barely started on the recovery mode before the virus again brought it down, Japan was already reeling into recession after an ill-timed hike in the value-added tax, the United Kingdom is still feeling the aftereffects of Brexit, and India has been experiencing massive fall in gross domestic product and its currency going down as compared to the United States dollar. As of now, the United States is in the best shape, but what once seemed like a 15-20 percent chance of a recession starting before the congressional and presidential elections in November now seems much higher.

David Kostin, the chief U.S. equity strategist of Goldman Sachs, warned that U.S. companies are expected to “generate no earnings growth in 2020,” and that “a more severe pandemic could lead to a more prolonged disruption and a U.S. recession.” Credit Suisse cut down its projection to 2.2 percent that is below the 2.5 percent growth rate by the International Monetary Find set as the threshold for a global recession. Conversely, the 2020 global growth forecast was cut down by Bank of America Securities and added it is now expecting the lowest reading since 2009.

The brutal drawdown in global financial markets is indicative of the fact that the world economy is possibly on a path to recession. Valuations of safe assets have spiked massively, with the term premium on long-dated U.S. government bonds falling to near record lows at negative 116 basis points that clearly suggests how much investors are willing to pay for the safe harbor of U.S. government debt. Because of this, mechanical models of recession risk have ticked higher. However, a global recession is still away for a while, at least.

China is struggling and down.

For February, the Caixin/Markit Manufacturing Purchasing Managers’ Index (PMI) for China came in on Monday at 40.3 — the lowest reading since the survey was launched in early 2004. Zhengsheng Zhong, the chief economist at CEBM Group, a Caixin subsidiary, said the manufacturing economy of China was impacted by the coronavirus last month as suggested by the private manufacturing PMI survey by Caixin/Markit.

Zhong added the supply and demand sides both weakened, supply chains became stagnant, and there was a big backlog of previous orders. The disease has massively impacted business activities and operations in the mainland with the Chinese government literally locking down cities for weeks and months while enforcing wide-scale quarantines to contain its spread. Zhong added the gauge for new export orders remained in the negative territory and added it further slumped to its lowest point since January 2009.

The official manufacturing PMI from the statistics bureau of China demonstrated February manufacturing activity in China shrank to 35.7 — the fastest pace on record.

The annual growth projections of China in 2020 were downgraded by Oxford Economics to 4.8 percent that would be the worst year of the Asian giant in decades. The status of China as an international trade and supply chain behemoth is likely to have a huge impact on the availability of products and parts around the world.

According to a new survey by the American Chamber of Commerce in China, a group representing members from 900 companies throughout the country, nearly half of U.S. companies in China are of the view that their revenue would decrease in 2020 if their operations don’t return to normal by the end of April. A majority of industries already have felt the sting with American giants like Disney, JPMorgan, Google, Apple, Starbucks, and Levi Strauss halting production and banning employee travel or shutting down operations in China.

The economic contagion could spread.

Now here’s how the coronavirus could cause a recession: People across the world have stopped going to concerts, restaurants, and movies due to the coronavirus threat. Airlines have canceled domestic flights and hotels, amusement parks, and museums have closed, and sports leagues have been scrapped.

Now comes the big problem – organizations might start laying off employees with less revenue and no certainty on when their business will bounce back. Newly unemployed workers will pull back spending, and others, fearing that their jobs could be next, would do the same. This would hurt demand for a wider array of products and services. This, in turn, would force more payoffs and push some organizations into bankruptcy.

Or let’s assume a slight twist: The disruptions in supply chains across the globe would make it difficult for manufacturers to get parts, and for small, medium, and large-sized retail organizations to stock shelves. With nothing to sell, they would be “forced” to lay off workers, which will set off the same cycle of job losses and reduced spending.

The common element in both cases: The ripples would reach further into the economy once coronavirus’s direct effects spread to the market. If that happens, the economy might stay sluggish even long after the outbreak is controlled.

Karen Dynan, a Harvard economist and former official in the Treasury Department, said the question is whether coronavirus pushes firms so far that they go out of business or start laying employees off and added that’s where you can get the bigger impacts on the economy.

The coronavirus will damage the economy.

The Coronavirus outbreak has already caused flights to be grounded, factories closed, and official gatherings canceled.

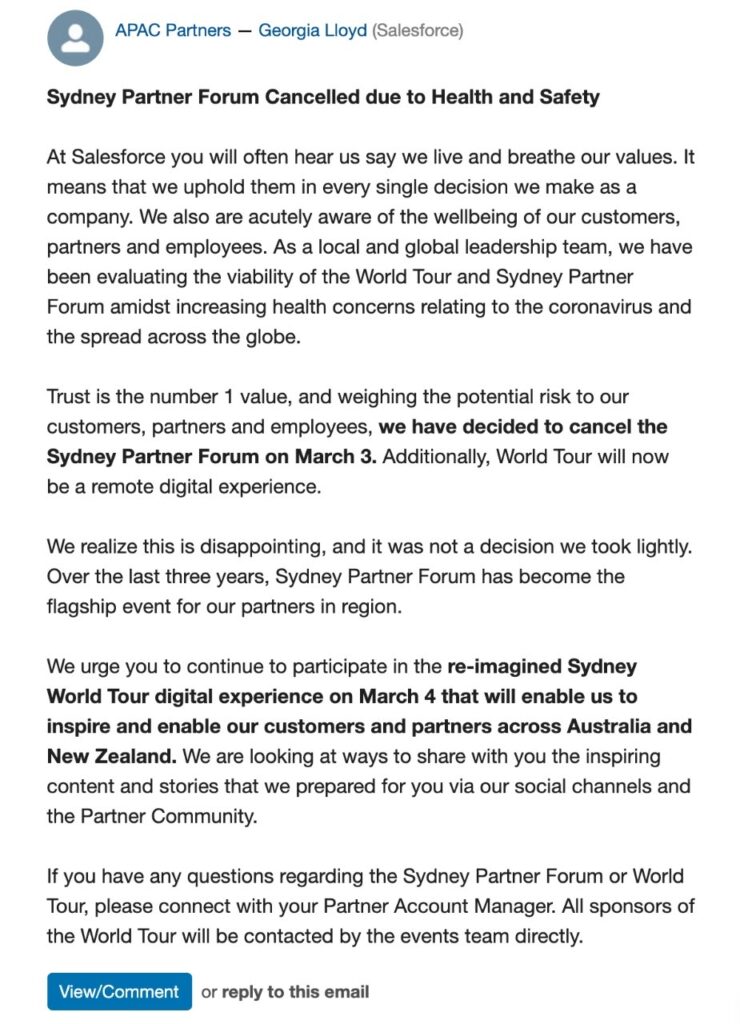

In recent weeks, many technology conferences were abruptly abandoned because of the threat posed by the coronavirus.

Sydney World Tour, the premier Australian conference of Salesforce, became the latest casualty of the epidemic. Salesforce, the CRM giant, announced a change in the format of its flashy Sydney World Tour event from an “in person event” to “an online experience” this year.

In recent weeks, Mobile World Congress Barcelona, Cisco Live Melbourne, and the San Francisco summit of Facebook were also abandoned.

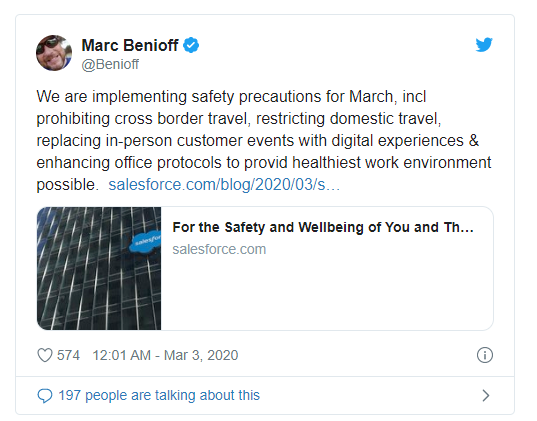

Salesforce even went on to suspend non-essential travel for its nearly 50,000 employees and ‘enhanced’ its ‘office protocols’ to fight the coronavirus spread.

Some of the industry’s biggest names, including but not limited to Mastercard, Apple, United Airlines, and dozens of other companies have warned that coronavirus will hurt their profits. Cities in Asia (especially China) and Europe are nearly shut down.

In recent surveys from the Federal Reserve Bank of Kansas City and the Institute for Supply Management, it emerged that organizations were nervous about the virus but that business activity was still increasing.

Kevin Hassett, a CNN economics commentator and the former White House economist, issued a warning that the world economy is likely to stumble into a recession if the outbreak of coronavirus is not contained quickly. Hassett said the first-quarter GDP growth of the United States is still likely to be positive and added if people are able to spread it outside of the flu season then this has legs through the summer and we are absolutely looking at a recession globally.

In a research note, Barclays said, “The rapidity of the deterioration in financial markets has elements of a viral pandemic induced panic that, if left unchecked, could spread to business and consumer confidence that could ultimately lead to reductions in spending and hiring.“

Bob Schwartz, the senior economist at Oxford Economics, wrote in a research note that the pernicious global economic effects of the COVID-19 virus are battering the financial markets, sending stock prices into correction territory in record time and driving interest rates to record lows.

Chris Rupkey, the chief economist at MUFG in New York, went on to remark that markets are voting and saying they think the U.S. is on its way to recession. Rupkey added it will be a miracle if we avoid a recession frankly at this stage after the coronavirus-related slowdown in travel plans that have busted the global supply chain apart.

On Monday, the Organization for Economic Cooperation and Development (OECD) said the global growth could be cut in half, to 1.5 percent in 2020, if coronavirus continues to spread. According to Goldman Sachs, the outbreak would reduce economic growth in the United States by a full percentage point in 2020 and an outright fall in gross domestic product.

Now comes the consolation news! A recession is more than just a dip in gross domestic product. It involves a cycle that feeds on itself: Cuts in jobs lead to less income that leads to less spending which in turn leads to more job cuts. This, of course, doesn’t stay on for an indefinite period, especially if governments and central banks intervene forcefully to kick-start growth.

Think about earthquakes or hurricanes. A big natural disaster can easily lead to a decline in output in one region of the country, as shipments are delayed, stores get closed, and people stay in their homes or shelters. A really bad disaster might even stimulate a dip in gross domestic product.

But barring other factors, the “victim” economy should ideally snap back once the ground stops shaking or water recedes. In fact, natural disasters are usually followed by a temporary surge in economic activities, as people rebuild. In that way, disasters are quite different from financial crises, for instance, which reduce investment and spending in the short term and also make individuals and organizations less willing or able to spend for months or years.

Till now, the deadly coronavirus outbreak looks similar to a hurricane than like a financial crisis but this may change suddenly.

The economy has a cushion (but it’s definitely not a big one).

Hardly anyone expected a recession in 2020 before the deadly coronavirus started spreading its jaws. Inflation is tame and the unemployment rate is near a low of 50 years. Job growth has been steady and the housing market has been gaining strength.

The underlying momentum could possibly help prevent a recession. Organizations that have been struggling to find sufficient workers might be reluctant to lay them off at the first sign of trouble. Households have a buffer to stay protected during a slowdown as the debt owed by them is relatively little.

The longer the coronavirus stays and the farther it spreads, the bigger these impacts will be. The only thing that the world can do is to hope that history repeats itself this time too and the coronavirus, like other epidemics, too peaks and passes quickly.